"We are evolving from a traditional 'youth policy information curation platform' to a platform that provides practical services that combine policy and finance. Whereas we previously focused on providing information and personalized recommendations, we are now designing a structure that helps young people implement that information. With approximately 100,000 monthly users, we are seeking to expand beyond being a simple information platform and become 'a platform that helps young people design their lives.' Starting in 2025, we will focus on empirical research and functional advancement to better understand and intervene in the financial lives of young people."

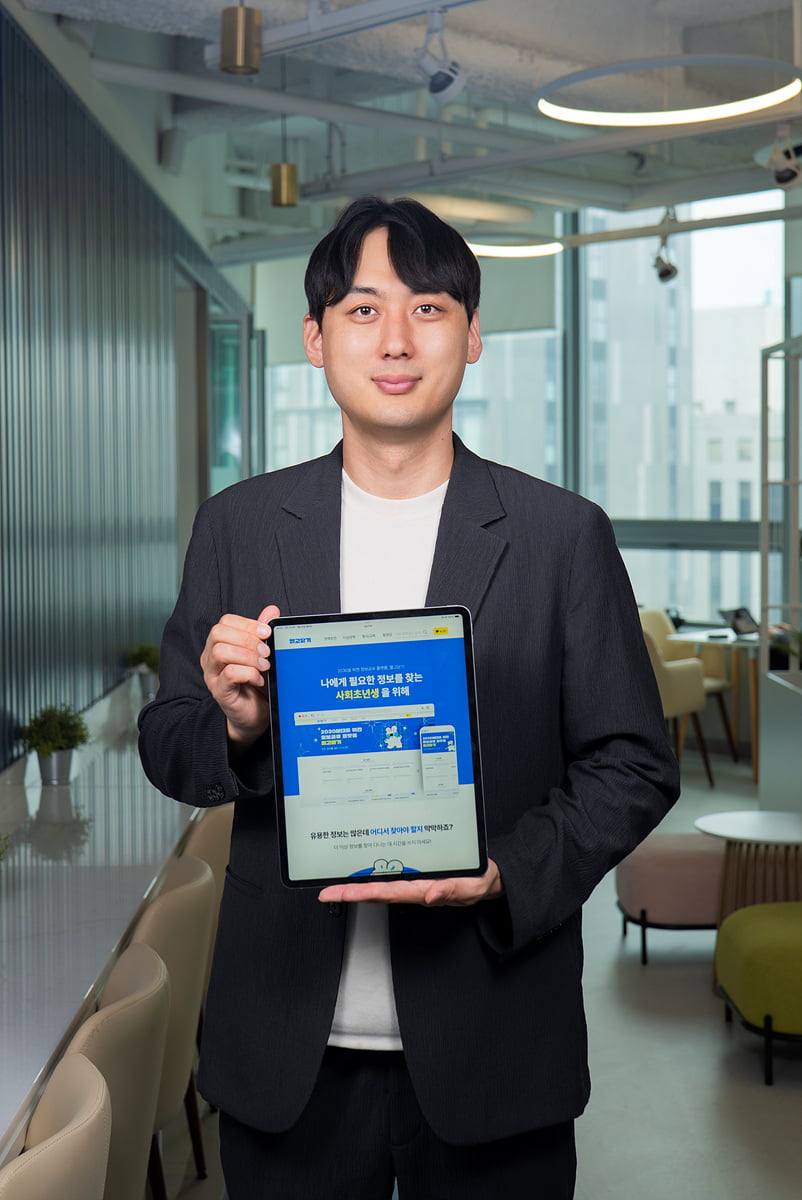

DODOHAN COLLABO is a startup founded to bridge the information gap and create social value. The company was founded in October 2019 by Won Kyuhee (38).

Won stated, "We operate a customized youth policy platform that enables young people to access and utilize the policies and information they require easily."

DODOHAN COLLABO 's flagship service, Open and Close, is a data-driven youth policy platform that helps young people find and utilize the policies and information they need without getting lost in a sea of information.

In February of this year, DODOHAN COLLABO surveyed 'Youth Financial Management and Savings Account Selection Criteria' with Kwangju Bank. In March, they surveyed 'Youth Financial Competence and Financial Happiness' with the Finance & Happiness Network. These surveys went beyond simply conveying information, attempting to gain a comprehensive understanding of young people's financial awareness, behavior, and psychological structure.

"Open and Close is developing an algorithm that integrates policies and financial instruments based on young people's income, employment status, place of residence, and policy utilization history. Furthermore, we are developing a personalized scoring model for young individuals with limited credit history, utilizing their policy participation history and financial practice data. This is an attempt to go beyond simple information matching and focus on the possibility that policy utilization can serve as an alternative indicator of credit. Our goal is to present a new financial inclusion structure that connects policy, finance, and data."

Open and Close's competitive advantages lie in its personalized recommendation structure, which integrates policy and finance; its user experience design, which encourages information practice; and its data-based scalability. Unlike existing platforms that merely list or compare information, Open and Close analyzes the likelihood of policy benefits and financial accessibility based on factors such as income, employment type, area of residence, and policy utilization history. It then provides integrated recommendations for preferential savings accounts, loans, housing policies, and other services for young people.

Additionally, recognizing that many young people are not inactive due to a lack of information but rather because they do not know 'where to start,' Open and Close designs action plans with intuitive content, such as card news, surveys, and simulators. It offers a structure that encourages users to initiate small steps.

Open and Close increases both policy utilization and platform traffic through a data marketing strategy that combines content marketing and survey research. A significant proportion of platform traffic originates from 'policy searches,' indicating that Open and Close serve as a tool for exploring actual policies, not just a content platform.

In addition to search-based policy traffic, Open and Close's weekly newsletter and YouTube channel curate key policy and financial information for subscribers. Its card news and survey-based content create regular touchpoints with young people. Life-oriented content, such as 'special savings accounts for young people,' 'comparisons of lease loans,' and 'summaries of local government subsidies,' induces high click-through rates and policy application conversion rates.

Regarding plans, Won said, "Open and Close is currently focusing on life planning through finance, particularly among young people. We are focusing on converting to a practice-based platform that goes beyond providing simple information to help young people start and continue financial activities."

Founded: October 2019

Main business: operating a customized recommendation platform for youth policy and finance

Achievements: Selected for the Impact Field by Brian Impact's Side Impact in 2024; Received a commendation for information culture from the Ministry of Science and ICT (ministerial commendation) in 2023; Received the Best Presentation Award at the Hamseongsori (Social Leaders Growing Together) IR Demo Day in 2023

reporter jinho lee

jinho2323@hankyung.com

관련뉴스